Total donations and bequests to Australian charities in 2016 and 2017 decreased by $1.3bn. Impact investment, which by its nature produces intentional, measured social and environmental outcomes, is experiencing rapid growth. As charity sector leaders, faced with complex revenue challenges, we must consider how we respond to these compelling trends and opportunities.

On 21st May 2019 the Australian Charities and Not-for-profits Commission (ACNC) published their latest data from the mandatory financial reporting it co-ordinates, The Australian Charities Report 2017. This report and others from ACNC provide many insights on the details of Australia’s 44,600 charities and their $142bn of revenue, 1.2m staff and 3.3m volunteers.

This report highlighted a trend in donations and bequests, when compared to previous reports:

- After 15% reported growth in donations and bequests between 2014 and 2016 to $11.2bn there have been two consecutive years of decline

- The 2017 ACNZ report stated that donations and bequests to charities have decreased by $600 million, following a similar decline the year prior

- Between 2015 and 2017, there was a total decline in donations and bequests to Australian charities of $1.3bn.

- During this same period, revenue increased by 5.5%, but expenses increased by 11%

As an advisor to the social purpose sector for nearly two decades, I have never met with a non-profit Board of Trustees that did not want to achieve greater outcomes aligned to their mission. When that mission is constrained by the traditional revenue streams of our sector, it is essential that we consider how other emerging opportunities can be effectively applied to our vision.

During this same period of decline in donations and bequests, the amount of money invested in formally defined responsible investment portfolios increased from a about $500bn to over $1 Trillion according to the Responsible Investment Association of Australasia (RIAA). Much of this has been driven by the increasing expectations of 90% of Australians and New Zealanders who care deeply about how their pension and private investments should be managed, evidenced in RIAA’s 2017 and 2018 Consumer Surveys.

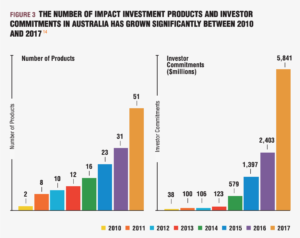

Impact investment is part of the responsible investment spectrum and has also seen significant growth. In 2018 RIAA stated that the data set of investable impact investment products in Australia has grown from $1.2billion in 30 June 2015 to $5.8 billion at 31 December 2017. A similar scale of growth is expected to be identified in a New Zealand report currently being developed.

Impact investment refers to investments that provide an intentional blended return; both a financial return and a measured positive impact for people and/or planet. Our UK-based advisor and former Independent Director of Big Society Capital, David Carrington, met with a number of social purpose organisations and investors in Australia and New Zealand in 2018. He describes it further as “the investment of funds in a social purpose organisation with the deliberate intention that those funds will help to secure clear, positive, and measurable social outcomes – a public benefit – while also generating a financial return to the investor, enabling the funds to be recycled and used again to support further activities.”

There are some serious challenges in our communities that can only be addressed through philanthropic funding and donations. We must improve philanthropic outcomes by investing in best practice fundraising, especially as we enter a period that will see the greatest transfer of wealth in history. There is an increasing body of knowledge and credentialled international best practice that is accessible to help our organisations with this.

These two unmistakeable and significant trends cannot be ignored by the social purpose sector. A proactive response is required from all non-profit Boards that involves the careful examination of opportunities to finance their mission.

*source : https://responsibleinvestment.org/wp-content/uploads/2018/07/Benchmarking-Impact-2018.pdf